Interview: Carrie Eldridge, a Blockchain and Art Entrepreneur With Values

For centuries, the art market has been an opaque market controlled by the elite, blockchain technology may change that. Cryptocurrencies run on blockchain technology, which, in simple terms, are a distributed system of ledgers. A number of new start-ups are attempting to bring this technology to the art world in order to track prices, authenticate works, fraction ownership, and, in different ways, create a more trust-worthy art market.

In Miami during Art Basel, billionaire heir and gallerist Adam Lindemann hosted a half-day art and blockchain event. He announced, “The blockchain will completely change the market.” Lindemann, who has invested Artblx, and a number of other blockchain and art ventures continued “if this works, we can see millions of more participants.” The question is, which of these companies will survive?

Lisa Phillips, director of New Museum in New York, another speaker at the event commented: “We’ve heard a lot about value but not a lot about values.”

Carrie Eldridge, founder, and CEO of ATO Gallery has created a platform that utilizes blockchain technology not only to cater to collectors and generate transparent data but also, primarily, to give artists more money for their work. Talk about values. Impressing the crowd, Eldridge, spoke at Art Decentralized, another panel during Miami Art Week.

I sat down with Eldridge, the visionary entrepreneur to speak about how she is using blockchain technology to empower artists.

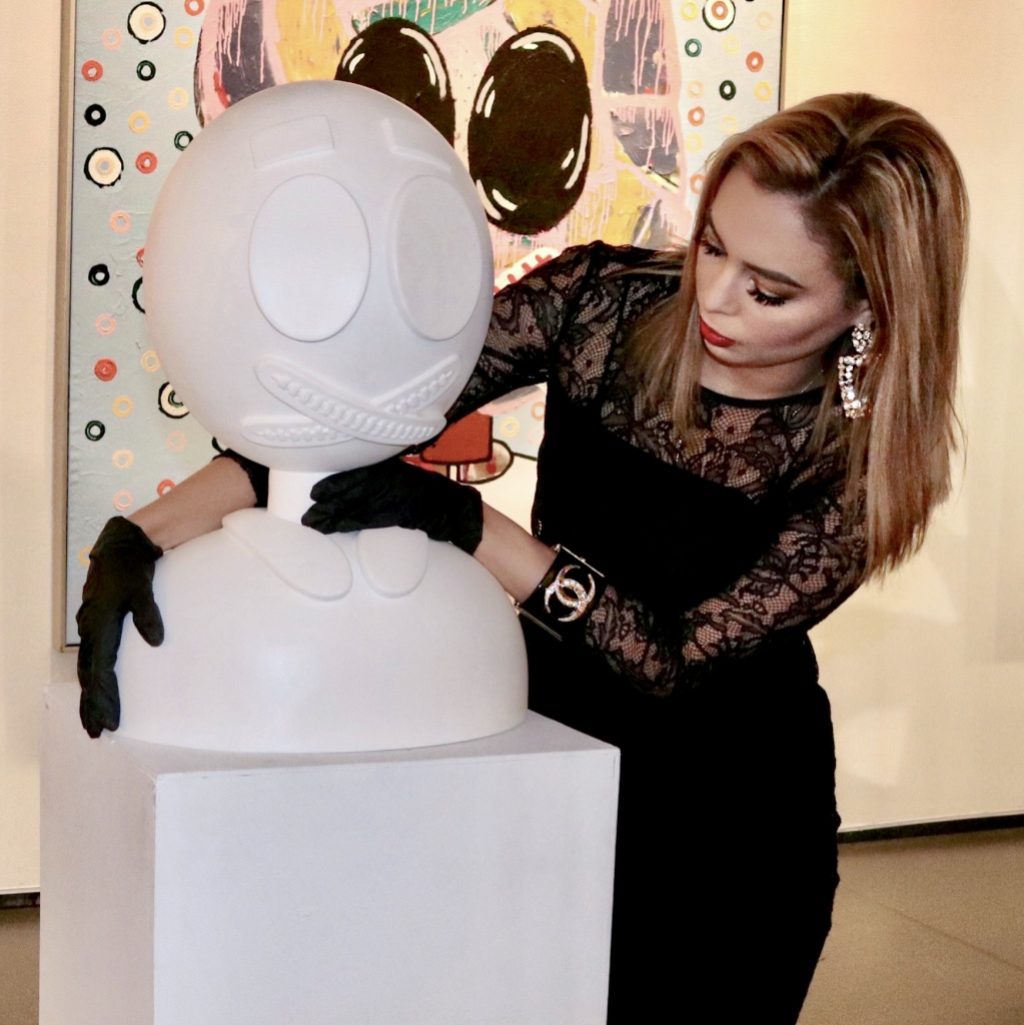

Above: Carrie Eldridge with work by Mr. Star City at ATO Gallery’s SoHo Pop-up, 2018. Previous: Soho based collector Gretchen Maull Berger, Mr. Star City, and Carrie Eldridge.

Above: Carrie Eldridge with work by Mr. Star City at ATO Gallery’s SoHo Pop-up, 2018. Previous: Soho based collector Gretchen Maull Berger, Mr. Star City, and Carrie Eldridge.

Anna Mikaela Ekstrand: How and when were you first introduced to blockchain technology, and when did you realize that you wanted to use it to disrupt the art market?

Carrie Eldridge: During college in 2008. But, it wasn’t until 2016 while I was working at Morgan Stanley that it dawned on me that combining financial logic with blockchain technology could alleviate many of the problems that artists and collectors face when engaging with the art market.

ATO Gallery is creating a stock market for artists. Why?

Recent research shows that more and more collectors, both young and old, consider art as an asset, to millennial collectors especially, the distinction is unquestionable. If collectors benefit from artwork appreciation and regard it as an asset class, shouldn’t artists also experience some of those positive gains in a more tangible way than popularity? Usually, artists supplement their art sales, if they have any, with other work until they find a patron, or reach star status. I just thought, there is no need for this when we have blockchain technology; with ATO’s sophisticated game theory model that allows for speculation and a free market to exist, artists, collectors, and traditional stock market investors can conduct research, trade, buy and sell options on artists, and even hedge portfolios of artists.

As collectors become more savvy auction houses and gallerists take more responsibility for the work they are selling-

Yes, there is a proposed extension of the Bank Secrecy Act (BSA) to the arts and antiquities market which would bring more regulation to the art market.

Exactly. Your model is both transparent and seems like it would work dynamically if the art market were to become more regulated. Did you take this into consideration when you created the platform?

We looked to the historical benchmark rulings on banking that the federal government has passed over the years for inspiration, the SEC, the NYSE, FINRA regulations, an economist like John Keynes for our modeling, and John Forbes Nash to create a model that would work securely and without interruption. Luckily, we didn’t have to reinvent the wheel, as brilliant minds had already worked out how to protect investors, and how to attain the tipping point of users in order to reach a Nash Equilibrium. When I told one of our artist’s that I could raise him enough money to not worry about his bills for years, he started to cry. The artist has shown at David Zwirner Gallery and a number of other prestigious galleries and institutions, yet he was having trouble making ends meet. He told me: “Carrie, this would change everything. If I can make what I need to make, I can die happy.”

Tell me about ATO Gallery’s artist tokens.

We started developing an algorithm in 2017 that considers a long list of variables about an artist. It calculates everything from sales history, price changes, to museum shows, availability of work, and acquisitions. Based on this information, expert analysis, and our set of metrics, we determine how much an artist needs to sell in order to progress in their career – much like when a company goes public in hopes of expanding with the new capital influx. Unlike a company’s public raise or IPO, we will have a number of rules and metrics to reach within different phases of the token raise in order to protect the investors, ensure that we reach enough users for liquidity in the secondary market, and to ensure we raise the minimum goal. Investors can withdraw their purchase in tokens within a certain amount of time during the buy-in phase. So that in the event the artist doesn’t reach one of the metrics, the investor gets all of their money back. Once you own artist’s tokens you can use them to actually buy art, or save them in your wallet.

We envision a world where people from all income levels and investment experience will hold portfolios of artists and use our tools to research their artists.

Carrie Eldridge, Founder of ATO Gallery

What do you say to those who question if the value of art is quantifiable?

Science magazine just published an article this month titled ‘Quantifying reputation and success in art’. I found it to be fascinating and reassuring that so many brilliant minds worked together to apply math and logic to a very subjective industry. It feels like validation, ATO is on the right track.

An educational approach, I like that. Who will buy your tokens?

We envision a world where people from all income levels and investment experience will hold portfolios of artists and use our tools to research their artists. Unlike holding public company stock, there is an additional excitement that comes with investing in art, and artists.

Million dollar artworks are slowly making their way into the mass market, albeit in different forms than their original. Coach teamed up with the Keith Haring Foundation to produce a line of clothing last year, t-shirts printed with Basquiat motifs are hanging on racks at Uniqlo and Comme des Garcons. Is this a fad or will art continue to permeate the mass market?

Art will certainly continue to penetrate the mass market. I believe that the fandom of fine art artists is the next major trend.

Who was the first artist you signed and how did it come about.

Brigitta von Bilderbeek. We went to college together at Southern Methodist University in Dallas Texas. I was an economics and finance major and she was studying fine art. One weekend, her work was in a gallery show that sold out. To me, that seemed like the easiest job in the world, at first. After I asked her about it, she explained that after her cost for art supplies, transporting the artwork, insurance, commission to the gallery, taxes in the USA and in her home of the UK, she barely broke even. Both art historians and collectors have told me that it is this struggle that “makes” an artist, I vehemently disagree. Which is why I founded ATO, to help artists economically. When I asked Brigitta to be our first artist and help advise along the way, she agreed without hesitation. We sold her first piece within a month, that’s when we knew it was real.

ATO Gallery represents an array of emerging artists; some are art world outsiders whereas others are connected to blue-chip galleries. Tell me about your philosophy behind selecting artists.

My maternal grandparents were avid art collectors and focused primarily on Japanese art and artifacts. I grew up going to museums almost every weekend with my mother or grandmother. I learned at a very early age that it’s not necessarily a degree or pedigree that makes a great artist, it’s the impact the work has on the human soul, and then, how many souls it can reach.

Our first art advisor Mark Busacca of the Busacca Gallery in San Francisco taught me a lot about artists’ selection starting in 2016 when I was still researching and studying the market. He taught me that I should look for five things in an artist before deciding.

- An artist can draw

- An artist must be a master of color theory

- An artist must know their art history, because how can you sit on the shoulders of the greats before you, if you don’t know their names and work.

- An artist must have a purpose, a message that is somewhat like an invention because it makes the audience think in a new way, feel something they never have before or can’t remember the last time they did.

- Finally, a great artist is one that punches you in the chest when viewing their work, or gives you a hug and makes you cry – it affects you in some memorable way. They appeal to your ethos, logos, or pathos.

We now have several brilliant curators, art dealers, and gallerist that guide our artists’ selection process, but these five rules are what guide me, and what I teach young collectors.

You are in your series A of fundraising, how do you keep level headed in this intense process of approaching and pitching to investors?

I am a saleswoman, I have been selling since the Girl Scouts, so I know it’s a numbers game. Every time I pitch I just remind myself of that fact and that “no’s” usually are not personal. I always ask for feedback, thank them, and move on. We have turned down a number of investors because we didn’t see them as strategic or having anything to add besides money. I also have to remind myself that this is just as big an opportunity for them as it is for us, so we can afford to be picky with who we take money from. I would suggest these two reminders to all entrepreneurs out there.

Who is your dream investor?

Someone that not only loves art, but also loves artists, and can see the big picture. We want them to see that we are not just a gallery, we are a true platform that other galleries can use as a software license.

How will I, as a user of your platform, track pricing and the whereabouts of artwork through ATO Gallery?

The prices of all artwork and any artwork that sold on the platform will be in one easy to read dashboard. The location of artwork once it has been sold is not public information with the only exceptions being if the art is sold to a museum, institution, or a well-known collector who wishes to publish the acquisition. Privacy of our collectors is paramount, only the dollar price is reported once art has been resold. We have designed a kind of ‘checks and balances’ reporting relationship into our governance and trade model.

What will the art market look like in 150 years?

There will be a tremendous amount of virtual art. Nearly every person will have the opportunity to own a high-powered wireless projector that can project multiple pieces of art on walls and sculptures that look real. The art projections will be licensed or owned as an official digital piece that can be bought and sold again thanks to a more sophisticated blockchain tool. Museums will charge a very small fee to give guided virtual tours so anyone can experience even a live event from their living room. There will be a consolidation of physical galleries which will become cultural epicenters that pay homage to the past while offering high-quality experiences to collectors and guests. The future is art.

If you could meet three people, alive or dead, who would they be and why?

Leonardo da Vinci for 1000 reasons or more, Martin Luther King to learn how to motivate people and constructively bring political parties together for a fair cause, and Albert Einstein to learn how to simplify problems.

You might also like

Blockchain Art: The Market is Here, This is What You Need To Know

From Ad Woman, Arts Writer, and Crypto-Guru to Artist, Herstory is Made as Alexandra Bregman Rebrands

Agnieszka Pilat: The Artist that Became the Darling of SF’s Tech Elite by Humanizing Machines

What's Your Reaction?

Anna Mikaela Ekstrand is editor-in-chief and founder of Cultbytes. She mediates art through writing, curating, and lecturing. Her latest books are Assuming Asymmetries: Conversations on Curating Public Art Projects of the 1980s and 1990s and Curating Beyond the Mainstream. Send your inquiries, tips, and pitches to info@cultbytes.com.