It’s Time to Rethink. The Carbon Cost of the NFT Boom

Over the last month, the hot topic of the art world has been the blockchain-supported transactions of digital art known as non-fungible tokens or NFTs. Considering that sentence has at least three concepts that are completely foreign to many people and were certainly not a part of everyday art conversations a month ago, it’s clear there is something new going on. What was once a niche art form and a currency one could easily ignore has now pushed its way into the closely-guarded art world. While artists, dealers, and collectors rush to understand NFTs from a technical and financial standpoint, there is a huge issue that needs to be addressed–NFTs have a significant carbon footprint.

Seemingly innocuous cat memes, screenshots of “Scam Likely” phone calls, and complex digital landscapes are all examples of NFTs. To fully understand the carbon footprint of an NFT requires a fair amount of information. In the simplest terms, NFTs are blockchain-based tokens that are paired with anything digital like artwork, music, and videos, and they cannot be duplicated, which creates scarcity and authenticity. NFTs are minted, meaning created, on a blockchain and some currencies, like Ethereum, can have contracts written into them. These contracts can say many different things such as the artist receives a portion of any future sale or that the artwork can change over time. Cryptocurrencies are supported by a huge network of computers, called miners, that work in order to establish blockchains for transactions. Blockchain transactions inherently include a digital ledger that (in theory) cannot be altered or undone. In traditional art terms, an NFT blockchain is comparable to provenance in that it documents and verifies ownership, sale price, and location or wallet address. That’s the simple explanation.

NFTs require significant amounts of energy to mint and sell. Unfortunately, this issue is often overlooked, not because the people involved don’t care, but rather the topics of digital art, blockchains, and cryptocurrency, in general, are essentially foreign languages to many people, and there are a lot of artists and collectors diving headfirst into the world of NFTs to capitalize on the current boom. In short, the computers working on blockchain transactions need the energy to function and, in the predominant model, all of the computers work at once and use a lot of energy. Studies have found that Bitcoin has an estimated annual carbon footprint comparable to the entire country of New Zealand and its power consumption is similar to Chile. Other studies say these comparisons are conservative and that the impact is even worse. The most commonly used currency for NFTs is Ethereum. The carbon footprint of Ethereum is comparable to the country of Zimbabwe and the power consumption is comparable to Ecuador. One Ethereum transaction is equivalent to the average US household energy consumption for nearly two days and the carbon footprint is equivalent to 4,462 hours of watching YouTube or 59,332 VISA transactions.

Aware of these facts, Turkish artist Memo Akten decided to investigate just how much energy is used for NFTs on an Ethereum blockchain. Akten analyzed over 18,000 NFT sales, roughly 80,000 transactions, which can include minting, bidding, sales, and transfers, on the marketplace SuperRare and reported that the estimated average energy consumption of a single NFT release was comparable to that of an EU resident for over a month. These numbers grow when releases are in editions and when they are resold. Akten also created a website that can calculate the estimated energy usage and emissions of an NFT. Seeking to refute these studies, blockchain advocates argue the inaccuracy and inflation of calculations, adding that some mining is “clean” because of its reliance on things like wind and water. However, clean energy sources are finite and ways to reduce consumption should always be considered.

Those unfamiliar with NFTs or dismissive of digital art may argue that this ecological issue isn’t a relevant, mainstream art topic. However, at least for now, cryptocurrency is permeating the art world, and the boundaries between the digital and physical art markets are becoming blurred. Almine Rech is releasing NFT editions by César Piette, Damien Hirst is experimenting with accepting cryptocurrency, familiar names like Kenny Scharf and Kenny Schachter both released NFTs, and blue-chip auction house Christie’s is selling an NFT that has already garnered 165 bids and $13,250,000. Art professionals not in the NFT scene are being forced to either get on board and learn the trade or watch as their collectors choose a digital file over a physical painting. The ease with which an artist can tokenize their work and sell it via platforms like Nifty Gateway, OpenSea, SuperRare, and Rarible to name a few, has opened the market to a new audience and democratized art-making and buying in an unprecedented way. All of these artists and collectors should be aware of the ecological implications.

Calls for change are happening. Twitter is rife with conversations about NFTs and several artists have published statements about the ecological issues. Flash Art recently published a series of manifestos about the environmental impact of cryptoart by several artists, theorists, and activists. With the thorough research of Memo Akten, people are slowly realizing the impact of these blockchain-supported artworks. French artist Joanie Lemercier posted an extensive blog about his experience minting and releasing NFTs, saying that the 6 editions he sold, which totaled 53 artworks, “consumed in 10 seconds more electricity than the entire studio over the past 2 years.” Lemercier has since stopped all releases of his NFTs.

Also rejecting crypto-art is the Barcelona-based artist collective Cabeza Patata. Created in 2018 by Katie Menzies and Abel Reverter to promote diversity and female empowerment, the duo took to their Instagram to post a statement about the carbon footprint of crypto-art and their decision to “morally reject” blockchain-supported transactions. The collective told Cultbytes: “The system of cryptocurrency might sound complicated but it couldn’t be simpler: Its value is created by wasting energy to create coins, and is guaranteed by knowing that even more energy will be wasted in the future to create more coins. We say ‘wasting’ not ‘using’ because this energy goes nowhere; it is not powering homes, light grids or transportation systems. It is simply being wasted and transformed into heating the planet.”

While these artists decided not to partake in NFTs, some are searching for ways to fix the issue. Artist and analyst Jason Bailey of Artnome put out a call for an NFT Green Grant that will function as a bounty system to reward people who find creative solutions to the problem of NFTs’ carbon footprint. Another group of artists has posted a forum that serves as a guide to eco-friendly crypto-art and suggests less wasteful platforms that use different cryptocurrencies, as well as ways to work around the problems inherent in Ethereum.

On the side of the cryptocurrency itself, not all mining is equal, and companies are taking steps that can reduce energy consumption and, as previously mentioned, use clean energy. For Bitcoin, the new farm in the city of Norilsk in Siberia is the first to open in the Arctic and capitalizes on the extreme cold temperatures of the region to reduce the energy needed for cooling, one of the most costly aspects of mining or computing. The farm is also made from scrap metal and uses hydropower and cheap gas from a nearby mining company (meaning traditional mining, not computing).

Exponentially more energy-reducing is the model currently being tested by Ethereum that shifts away from Proof of Work (PoW) to Proof of Stake (PoS). Called Ethereum 2.0 or Eth2, the shift has been in the works since 2014, before Ethereum as it is today was even launched, and is being rolled out in stages over the next year or few years. In simplified terms, the shift cuts down on the computation power required to validate a block in the chain by using only a portion of the miners (PoS) as opposed to all of them (PoW), therefore cutting down energy consumption. Ethereum even acknowledges on its website that the current PoW model uses too much energy. Nifty Gateway has stated that they are moving towards a similar PoS scaling model that will significantly reduce the number of mines activated to validate a transaction.

Other platforms are taking a different approach to sustainability by purchasing carbon offsets that are purported to make up for their footprint. The NFT marketplace Zora made a 50 ton carbon offset last week. However, offsets shouldn’t be taken as an excuse to continue to operate with wasteful practices. Defending their platform, SuperRare posted a blog last week refuting claims that NFTs increase carbon emissions, writing, “while well-intentioned, the argument that NFTs cause carbon emissions is untrue, and is based on a misunderstanding of how Ethereum works. That said, Ethereum itself is energy-intensive and as part of our core values we are committed to pursuing more sustainable solutions.” The company then continued to deflect blame onto Ethereum itself, acknowledged the need to fix the PoW system and adopt a PoS model, and announced its own plan to purchase carbon offsets. The fact is, there is a problem these companies are trying to fix. Whether the problem stems from within the company or from the currency it operates on is irrelevant.

Contemporary street and NFT artist Bud Snow pointed to some of these positive alternatives: “The most alluring aspect of NFTs is that I’m able to sell my work outside of the US dollar and the Big Banks, which use our money to run oil pipelines through native lands, and to fuel oil wars in other countries. NFTs provide immutable authorship, provenance, and royalties of my work. This levels the playing field making the art world a more equitable space. The developing green-NFT space, with gas-less platforms like Wax, Polkadot, Iota, and Cardano, and ETH 2.0, makes this a technology worth looking into.”

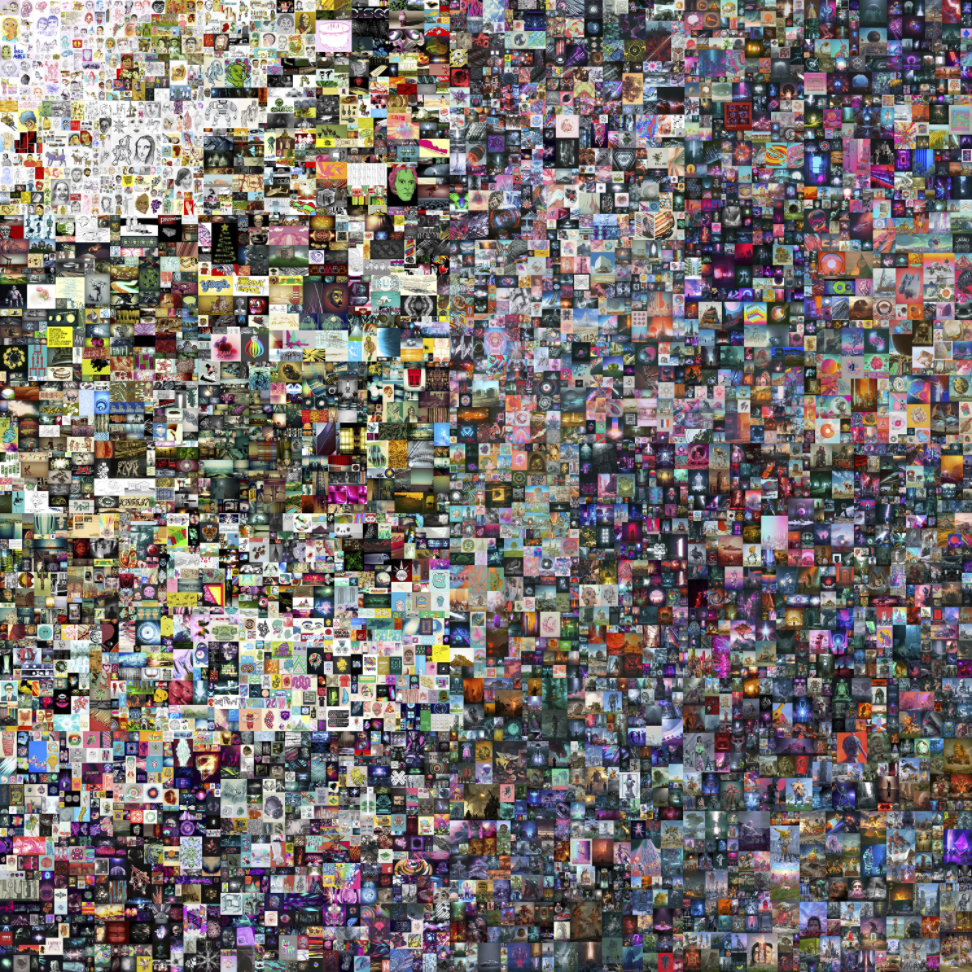

On the mainstream art front, Christie’s has emerged as a pioneer with its major single-lot NFT sale. Stretching over a two-week period that will end on March 11, the sale of “EVERYDAYS: THE FIRST 5,000 DAYS” by digital artist Beeple has gained 165 bids with the price currently at $13,250,000. Coincidentally, Christie’s just announced that they have formed a Global Sustainability Initiative. Cultbytes reached out to address the ecological toll of the sale in light of their sustainability pledge. A Christie’s spokesperson said, “Christie’s has approached the NFT market very judiciously, offering this one work as our first step into this nascent space. We will continue to evaluate NFT art in the larger context of Christie’s fine art offerings going forward. Should we choose to further our involvement in this area, we will prioritize working with third parties that are aligned with us on our long-term sustainability pledge to be net-zero by 2030.”

The biggest concern is whether each bid on Beeple’s work is included on the blockchain, or just the final buyer. Christie’s explained, “All of the bids are being made on Christie’s transactional platform, and only the final bid will be recorded on the blockchain, which reduces the footprint of this sale.” On the future of NFTs and whether they would consider implementing a scaling system like PoS, they added, “Although we do not have any future plans to speak of, the majority of our transactional activity for this sale takes place on our platform rather than on the blockchain.”

Christie’s also commented on their decision to commit to sustainability: “Christie’s began the process more than a year ago. Clients increasingly expect it of us, many of our employees are already advocates of change, and we recognize that as a market leader in our industry, Christie’s has a responsibility to take a lead. From now on, the lens of sustainability must inform all of our activities. We understand that making good on these commitments will require a shift in culture and recognise that there is much to be done to adapt across the business.”

While Christie’s is approaching NFTs judiciously, cryptoart at large is booming. Marketplaces and cryptocurrency companies must make the necessary changes now. Cabeza Patata commented, “Cryptocurrencies are not bad for the environment accidentally: their continued value comes from wasting energy. No carbon offset, green production or charitable donations will change that fundamental truth. The promise of those potential alternatives simply make us feel better, stop thinking about the devastating environmental impact, and be complicit in this crime against the earth…we need to carefully consider the change we want to see; one that promotes equality while inviting more people to create and live from their artworks, or one that promotes speculation, making a few rich while destroying the planet for everyone else.” Sustainable practices should be embedded in the system itself. Artists and collectors need to be aware of the ecological impact of NFTs and deserve transparency from the platforms they are using to fully understand the carbon cost of their transactions.

Some argue that it’s unfair to criticize the energy needed for NFTs when non-blockchain sales of physical artwork can be just as costly. Indeed the commonly accepted wasteful practices of the art world, in particular the blue-chip sector, can make NFTs seem like the more eco-friendly option. However, how common is the practice of calculating the carbon footprint of physical artwork? The tendency to expend monumental resources to promote a sale is embarrassing, and all of these resources, from flying the artwork around the world for viewings to printing thousands of pages of glossy printouts and catalogs, should be taken into consideration when calculating the carbon footprint of a physical sale. Ultimately, the conversation shouldn’t be the lesser of two evils; both practices need to be reevaluated. The effects of the climate crisis are unignorable, and every activity we engage in should be done with careful consideration of the environment. The art world needs to embrace sustainability as part of the framework of the entire industry and, at least for now, NFTs are a part of that story.

SALE UPDATE: At Christie’s, the NFT work “EVERYDAYS: THE FIRST 5000 DAYS,” 2021, went under the hammer for $69,346,250. The sale places its artist, Beeple, amongst the top three highest-selling living artists at auction.

You might also like

‘Galleries Commit’ Envisions a Greener Future for the New York Art Scene

What's Your Reaction?

Annabel Keenan is a New York-based writer focusing on contemporary art, market reporting, and sustainability. Her writing has been published in The Art Newspaper, Hyperallergic, and Artillery Magazine among others. She holds a B.A. in Art History and Italian from Emory University and an M.A. in Decorative Arts, Design History, and Material Culture from the Bard Graduate Center.